MarketClub’s Trade Triangle technology just issued new buy signals for 3 high volume, well-known stocks.

Our technology has alerted members of these major trend shifts which propel these stocks into levels of great trend strength.

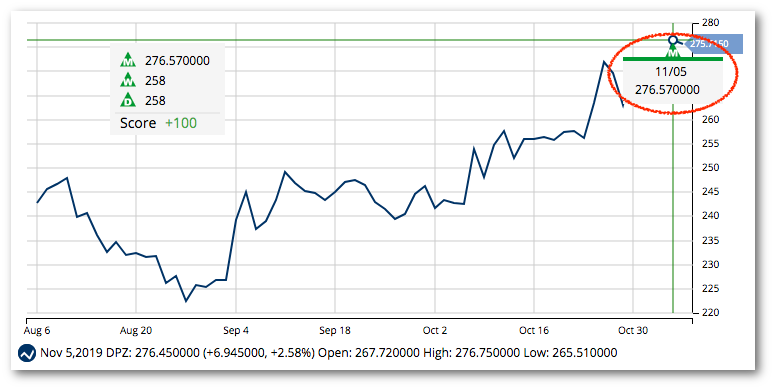

Dominos Pizza, Inc. (NYSE_DPZ)

Domino’s Pizza, Inc., through its subsidiaries, operates as a pizza delivery company in the United States and internationally. It operates in three segments: U.S. Stores, International Franchise, and Supply Chain. The company offers pizzas under the Domino’s brand name through company-owned and franchised stores.

Domino’s Pizza, Inc., through its subsidiaries, operates as a pizza delivery company in the United States and internationally. It operates in three segments: U.S. Stores, International Franchise, and Supply Chain. The company offers pizzas under the Domino’s brand name through company-owned and franchised stores.

Symbol: DPZ

Avg. Volume: 883,732

Market Cap: 11.3B

A new monthly Trade Triangle was issued for DPZ on 11/5/19 at $276.57 and the short-term, intermediate-term and long-term trends are all pointing in the same direction. This Chart Analysis Score of +100 confirms that the uptrend is strong and likely to continue.

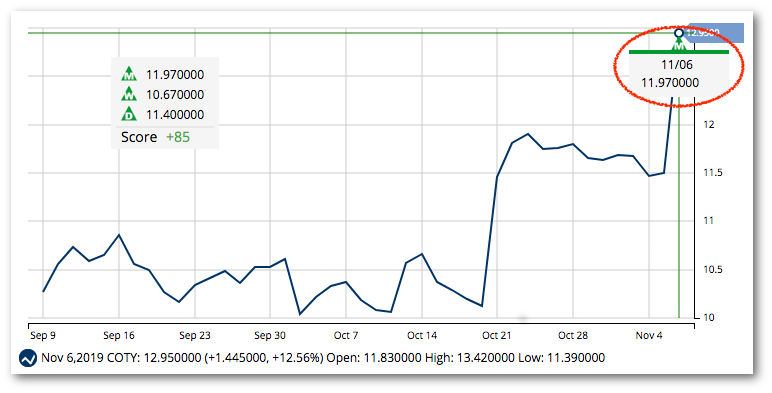

Coty, Inc. (NYSE_COTY)

Coty Inc., together with its subsidiaries, manufactures, markets, distributes, and sells beauty products worldwide. The company operates in three segments: Luxury, Consumer Beauty, and Professional Beauty. The Luxury segment offers prestige fragrances, and skincare and cosmetics products.

Coty Inc., together with its subsidiaries, manufactures, markets, distributes, and sells beauty products worldwide. The company operates in three segments: Luxury, Consumer Beauty, and Professional Beauty. The Luxury segment offers prestige fragrances, and skincare and cosmetics products.

Symbol: COTY

Avg. Volume: 4,455,281

Market Cap: 10.12B

A new monthly Trade Triangle was issued for COTY on 11/6/19 at $11.97 and the short-term, intermediate-term and long-term trends are all pointing in the same direction. A Chart Analysis Score of +100 confirms that COTY is in a strong uptrend with the technical backing to continue its move.

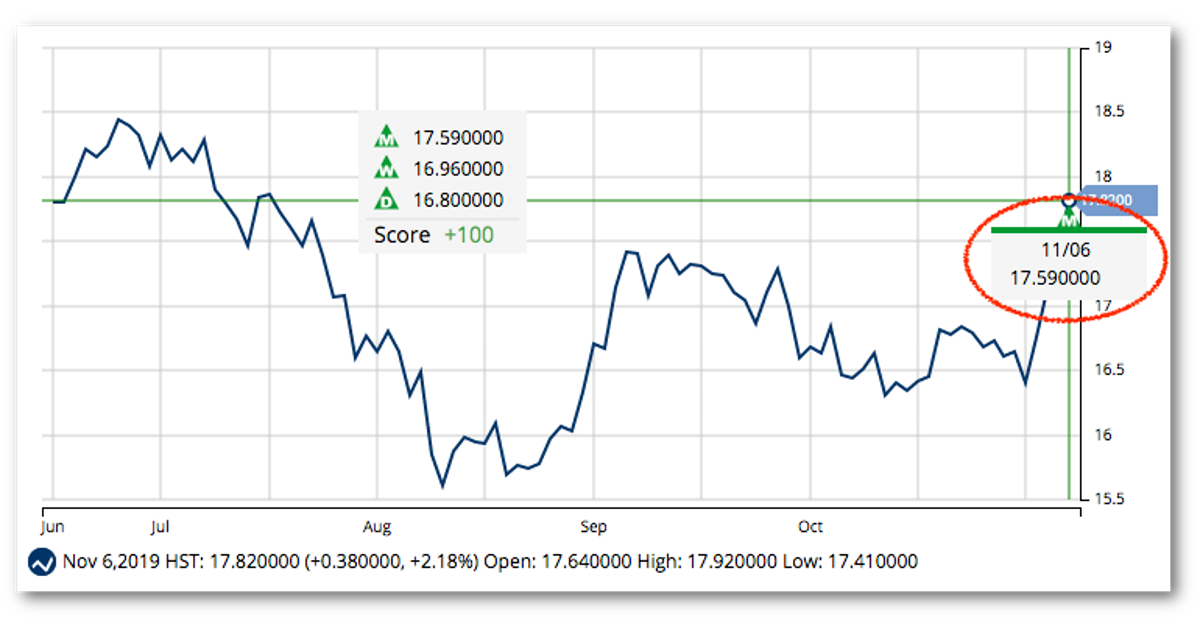

Host Hotels & Resorts, Inc. (NYSE_HST)

Host Hotels & Resorts, Inc. is an S&P 500 company and is the largest lodging real estate investment trust and one of the largest owners of luxury and upper-upscale hotels. The Company currently owns 83 properties in the United States and five properties internationally totaling approximately 50,000 rooms.

Host Hotels & Resorts, Inc. is an S&P 500 company and is the largest lodging real estate investment trust and one of the largest owners of luxury and upper-upscale hotels. The Company currently owns 83 properties in the United States and five properties internationally totaling approximately 50,000 rooms.

Symbol: HST

Avg. Volume: 7,243,343

Market Cap: 12.3B

A new monthly Trade Triangle was issued for HST on 11/6/19 at $17.59 and the short-term, intermediate-term and long-term trends are all pointing in the same direction. This stock is rated as a +100 with all trends strongly moving in the same upward direction.

Join MarketClub to get up-to-date lists with new buy signals for stocks, ETFs, futures, forex, and ETFs!