Value stocks can be found in every market sector and at any point in the economic cycle.

They aren’t just the ones hovering near 52-week lows or navigating a choppy business environment – sometimes, a value stock can be a cyclical stock that has still been stealthily performing during its usual low point in the cycle.

For one cyclical stock, the upcoming year may help boost profits for both the company and investors.

SNA Stock – Hidden Value Play

Snap-on Incorporated (SNA) is a $9 billion small tools and accessories manufacturer that is known best for its eponymous Snap-on tool brand line. The company’s line of tools are used in applications ranging from household needs to heavy-duty industrial, aviation, railroad, and more.

The company reported a 3rd quarter earnings beat of $2.96 per share, topping the estimated $2.94 per share. It beat the last quarter on a year-over-year basis by 2.8%, signifying positive growth in the company.

Over the last three months, the broader market indexes have been driven primarily by cyclical stocks. Following three rate cuts by the Fed this year, the positive effects will likely show up in the first half of 2020 – and it could be a significant economic accelerant for cyclical stocks like Snap-on.

Analysts haven’t caught wind of this stock’s potential yet, which means savvy value investors have an opportunity to buy while the stock is still under-appreciated.

The Fundamentally Structured

The stock trades cheaply at just 13 times earnings compared to the industry average of 23 times earnings. That is well under the S&P 500 average of 30 times earnings.

The long-term EPS growth rate estimate of 12% gives the stock a PEG ratio of about 1 – a strong indicator that the stock is undervalued. It carries a solid 2.60% dividend yield as well; recently bumped up nearly 14% from the prior quarter.

The Technically Inclined

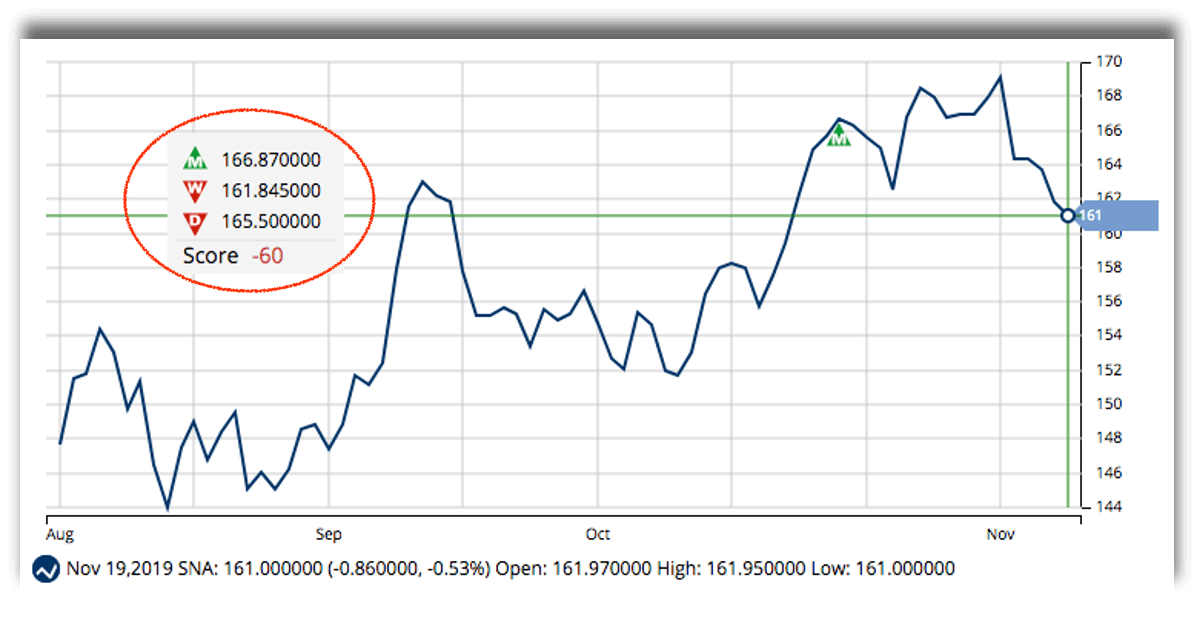

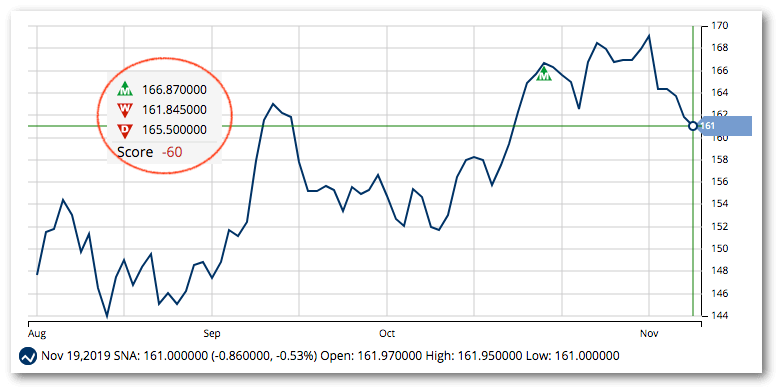

The chart for Snap-on shows a lot of up and down movements along with more than one SMA cross-over. The trademark “golden cross” where the 50-day SMA crossed over the 100-day SMA happened on November 1st – traditionally a sign of impending bullish momentum. The stock has dipped since then but on fewer-than-average trading volumes. With bad news already priced into the stock, it won’t take much to initiate a long term bullish trend.

The Bottom Line

Based on Snap-on’s full-year EPS estimates, this stock should be fairly valued at around $190 per share – a gain of around 15% from its current trading price. Investors who are bullish on the economic outlook for 2020 can get a head start by building a long position in Snap-on Incorporated.

The above analysis of SNA was provided by Daniel Cross, professional trader and financial writer.

What Does MarketClub Say

MarketClub isn’t showing a clear trend for SNA… yet.

With a Chart Analysis Score of -60 and choppy market action, our technology is telling members to play it cool, but keep an eye on SNA.

MarketClub’s tools help members ride only the strongest of trends. With a weak trend score and conflicting signals, it may be best to wait until SNA begins to make its move up.

Want to know when SNA strengthens? Set your score alert in MarketClub or add it to your portfolio watchlist.

Not a member? Not a problem! Join MarketClub now to see analysis and our signaling tools for SNA and 350K+ markets.