The coronavirus pandemic has been the number one priority for everyone lately and rightly so. The continued “social distancing” protocols have meant a paradigm shift in the way people live, work, eat, and play.

Many industries are seeing enormous changes and unexpected hits to their bottom line. Restaurants, in particular, have faced unprecedented challenges – especially those banking on dine-in customers. But some businesses thrive on adversity where others fail.

For one restaurant company, adaptability and innovation are a winning combination that means big things to come for investors.

A Best-In-Class Fast-Casual Restaurant Chain

Chipotle Mexican Grill, Inc. (CMG) is a $20.7 billion fast-casual restaurant chain with operations in the United States, Canada, United Kingdom, Germany, and France. Specializing in tacos and Mission-style burritos, Chipotle has more than 2,000 locations from which it can deliver its menu items.

The company reported 4th quarter earnings of $2.86 per share, beating the analysts’ estimates of $2.75 per share. Around 20% of the company’s sales came from digital orders, while same-store sales growth soared to 13.4% compared to the expected 9.5%.

As the coronavirus continues to redefine how the world operates on a day-to-day basis, Chipotle is a company that knows how to quickly adapt to change and find ways to grow the business and brand. It’s no stranger to online ordering, making it an ideal survivor in the food industry. As a proven innovator, Chipotle is undoubtedly well-suited to thrive in this volatile economic environment.

The stock has seen a flurry of analyst upgrades and reiterations over the past couple of months with price targets that range from $720 per share to $1,000 per share. These revisions give investors a heads-up that Wall Street is quickly catching on to this opportunity.

Dishing Out the Fundamentals for CMG

The stock trades at 55 times earnings compared to the S&P 500’s average P/E ratio of 28, which marks it as a classic growth stock. But it carries a low price-to-sales ratio of 3.1, making it an attractive pickup for both growth and value investors.

Chipotle has very little debt overhead with its debt-to-equity ratio of less than 0.01. This low ratio makes the company highly flexible to the current fast-changing business environment.

Serving Up the Technicals for CMG

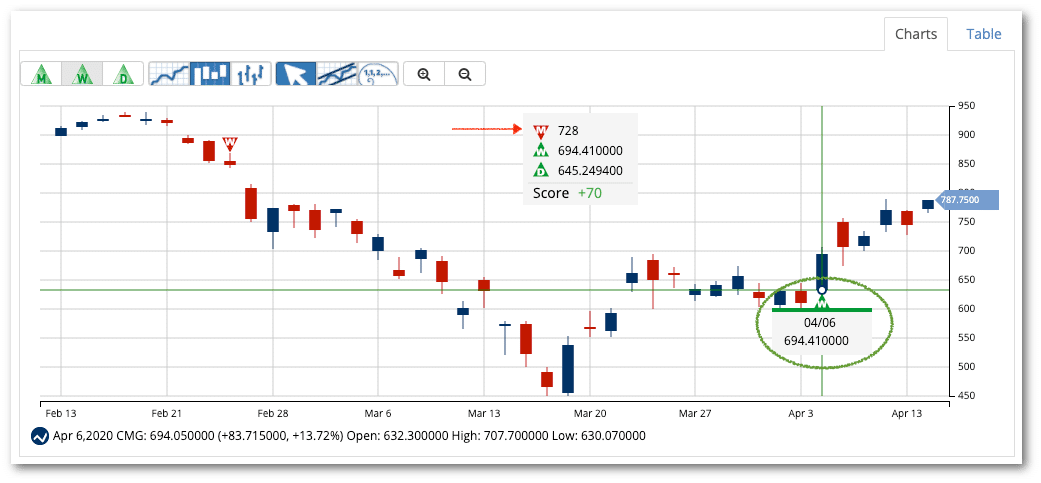

Chipotle’s stock chart shows a steady trend higher occurring for several months prior to the COVID-19 outbreak. The initial “social distancing” guidelines meant a sharp drop in the stock price, but as online order and delivery services hit record new demand, the stock reversed course, quickly regaining lost ground.

The shorter-term 20-day SMA is quickly closing the gap with the longer-term SMAs and should crossover in the next week if the momentum continues.

The Bottom Line

Based on Chipotle’s full-year EPS estimates, this stock should be fairly valued at around $925 per share – a gain of roughly 24% from its current price.

For investors looking for companies that will continue to grow and profit both during the pandemic and after, Chipotle looks ready to deliver.

What Does MarketClub Think of CMG?

While MarketClub has picked up on short-term momentum, the long-term trend for Chipotle is still pointed down. The Chart Analysis Score is +70 for CMG.

Like many stocks, Chipotle hit a 1-year low in the middle of March 2020 before springing up more than $400/share.

CMG has made a strong move over the last month. However, MarketClub has not yet triggered a monthly Trade Triangle to truly mark the beginning of a solid, long-term uptrend.

Get the next monthly Trade Triangle for CMG as soon as it is issued.