If the past couple of months have taught us anything, it’s that economic downturns can happen at any time.

There aren’t always warning signs of a bear market – a black swan event like COVID-19 can quickly derail a booming economy. An unexpected event like what we’ve experienced in 2020 can spell disaster for an unprepared portfolio as we enter a potential recession or depression.

Recession-Proof Your Portfolio Checklist

While building a portfolio that is perfectly defended against an economic recession is unrealistic, there are steps you can take to protect your assets even in the most volatile bear markets.

☑️ Diversify

You’ve heard it said so many times, and you probably know it by heart already but – diversify, diversify, diversify!

Unfortunately, many investors still aren’t sure what true diversification entails.

Having a portfolio that includes at least 5, but no more than 20, stocks assures that a poor performing investment won’t severely damage your overall returns.

A solid portfolio should have a mix of small-cap, mid-cap, and large-cap stocks and include a wide range of market sectors.

No more than 20% of a portfolio should be allocated to any individual sector. If one sector under-performs, it won’t drag down the whole portfolio.

Let’s take a look at how this works with a sample portfolio with an overall value of $100,000:

$10,000 – JPMorgan Chase (JPM)

$20,000 – Exxon Mobil (XOM)

$10,000 – Freeport McMoRan (FCX)

$10,000 – Johnson & Johnson (JNJ)

$10,000 – Facebook (FB)

$15,000 – General Motors (GM)

$10,000 – Vornado Realty Trust (VNO)

$10,000 – Newmont Corporation (NEM)

$5,000 – Money Market Savings Account

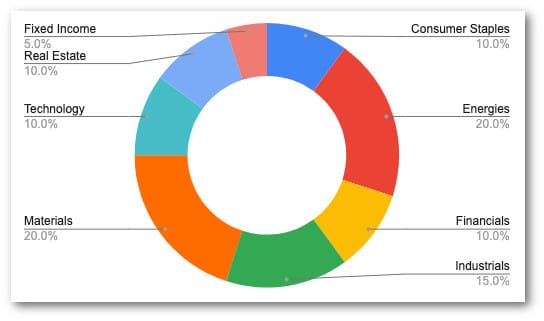

Sector Weights of This Portfolio:

This portfolio is well diversified with no more than 20% allocated to any one sector.

While an investor could add to their portfolio, they would not want to add any positions from the energy or materials sector in order to keep their portfolio diversified.

☑️ Cyclical Versus Non-Cyclical Stocks

Along the same lines of diversification, investors should keep in mind how stock sectors are labeled – cyclical or non-cyclical.

Cyclical sectors are areas of the market that prosper or decline depending on the economy’s business cycle. Sectors that fall in this category include energies, industrials, and manufacturing. They are often subject to ups and downs as the economy ebbs and flows and tend to be more volatile than non-cyclical stocks.

Non-cyclical sectors don’t follow the business cycle. These companies generate steady profits and usually don’t see a change in demand no matter what the economy is doing. Sectors like utilities, healthcare, and consumer staples are goods and services that consumers need, no matter if the economy is booming or in a recession.

Here’s a quick reference to show what stock sectors are generally classified as cyclical or non-cyclical:

Cyclical Sectors

- Consumer Discretionary

- Energy, Financials

- Industrials

- Materials

- Real Estate

- Technology

- Communications

Non-Cyclical Sector

- Consumer Staples

- Healthcare

- Utilities

☑️ Use Beta Ratios to Limit Volatility

Another way to defend your portfolio is to look at each of your stocks’ beta ratio. This figure tells you how correlated it is to the broader indexes like the S&P 500 or Dow Jones Industrial Average.

For example, if a stock has a beta of 1, then the stock should follow the indexes’ performance. If the S&P 500 gains 0.50%, then the stock will likely increase the same amount. A beta of more than 1 indicates that the stock will react more strongly to market movements, while a ratio of less than 1 means that it will only partially follow along.

Some stocks can have negative beta ratios. This value means that the stock is inversely correlated with the broader indexes – in other words, it will move in the opposite direction. You can also calculate the weighted beta value of your entire portfolio by factoring in all the betas of your individual stocks to see how aggressive or defensive it is using 1 as a benchmark.

For example, let’s take a portfolio of just two stocks:

70% is invested in JPM (beta of 1.18)

30% is invested in Duke Energy DUK (beta of 0.36)

Calculate the average weighted beta as follows:

(0.70 * 1.18) + (0.30 * 0.36) = 0.93

So this portfolio has an overall beta of 0.93 – less than the S&P 500 value of 1.0.

☑️ Add Options to Give Your Portfolio an Extra Layer of Defense

You can utilize options to keep your portfolio well armed and ready to handle virtually any contingency.

While the idea of using options in addition to your stock portfolio can seem daunting to some, there are a number of conservative option plays you can use without assuming unnecessary risks. Learn a simple options strategy you can practice with MarketClub.

One of the most commonly used stock option combinations is a covered call. If you already own the underlying stock, then selling a call at a higher price gives you upfront profits, thereby lowering your breakeven point.

Buying put options is an alternative route you can take. In this case, buying a put at a lower price than your stock is currently worth ensures that the potential losses on any given stock are never more than you anticipated.

Learn the Power Stock Strategy – a simple options technique that helps you uncover the strongest stock moves to leverage the profit potential of volatility.

☑️ Resist The Panic

When you see the stock market shedding value and the headlines blasting negative news, it’s all too easy to fear for the worst. But if there’s only one rule you really need to live by, it’s this – no one ever made money by panicking!

It’s important to keep perspective during a sell-off. The stock market is a dynamic organism with natural ups and down over time. But if you have a long-term investment strategy, then a temporary drop won’t derail your portfolio. Remember – the only time you really suffer a loss is when you hit sell.

The stock market will eventually recover no matter what crisis occurs. If you need a quick reminder, just take a look at the S&P 500’s performance from 2007 to today – the subprime mortgage crisis hit the global economy hard and the markets sank to gut-wrenching lows. But, even if you had invested in 2007 right before the crash, by today your portfolio would have still doubled in value.

The Bottom Line

You don’t have to sacrifice long-term profits to stay defensive against market downturns. Selling your stock holdings and placing your money in a money market fund may protect it from dropping. However, it also means you could miss out on any recovery in the markets.

A well-conceived and properly managed portfolio will help investors weather the storm AND be in a position to jump on once-in-a-lifetime opportunities.

It’s also imperative that you stick with your plan. When you use a service like MarketClub, you follow a set of rules to keep you consistent despite panic around you. There are always opportunities if you know where to look – thankfully, MarketClub does that searching for you!

Prepare and plan – don’t panic.

Always remember that there isn’t a one-size-fits-all checklist. Consult a licensed financial professional who understands your unique situation and risk tolerance before making any decision when it comes to your money.

This checklist was prepared by Daniel Cross, financial writer and analyst.

Get Cross’ weekly stock pick every Tuesday – request the stock of the week here.