Regardless of whether you’re a conservative, income-oriented investor or an aggressive, growth stock champion, a well-diversified portfolio needs a solid large-cap stock keeping it grounded and stable.

In light of the coronavirus outbreak, having a solid large-cap performer is an essential addition to any investor’s portfolio.

This consumer staples company not only minimizes portfolio volatility, but at the current stock price, it may be a value pick-up.

A Best-In-Breed Household Brand and Long Term Investment Superstar

Colgate-Palmolive Company (CL) is a $60 billion household and personal products conglomerate that produces and distributes a wide range of household, health care, personal care, and veterinary products.

The company reported a slight earnings beat of $0.75 per share compared to the analysts’ estimates of $0.74 per share for the first quarter. Net sales came in 5.5% higher than the same quarter last year at around $4.1 billion. However, management elected to withdraw its previous 2020 guidance citing unknown factors regarding the impacts of COVD-19.

The COVID-19 pandemic changed the business landscape virtually overnight and forced many companies to learn how to adapt quickly to meet the sudden influx of online demands. E-commerce spiked over 100% growth in nearly every category, while direct-to-consumer sales saw a similar boost.

Colgate-Palmolive switched its business strategy and focused on selling directly to end-market consumers to take advantage of the trend. This pivot could offer a long-term benefit.

The stock saw a flurry of upgrades in March from SunTrust, Stifel, Morgan Stanley, and BofA/Merrill. Recommendations changed from “neutral” or “equal-weight” to “buy” or “over-weight.” This rating change is a signal to investors that Wall Street is getting behind this company’s growth story.

The Fundamental Side

The stock trades at 24 times earnings, just under the consumer staples sector’s average multiple of 26 times earnings. One of the highlights of the stock is its 2.50% dividend yield, keeping investors protected against sharp downside movements. The payout ratio of 58.50% ensures investors that it has plenty of room to continue paying out a stable dividend for the foreseeable future.

The Technical Side

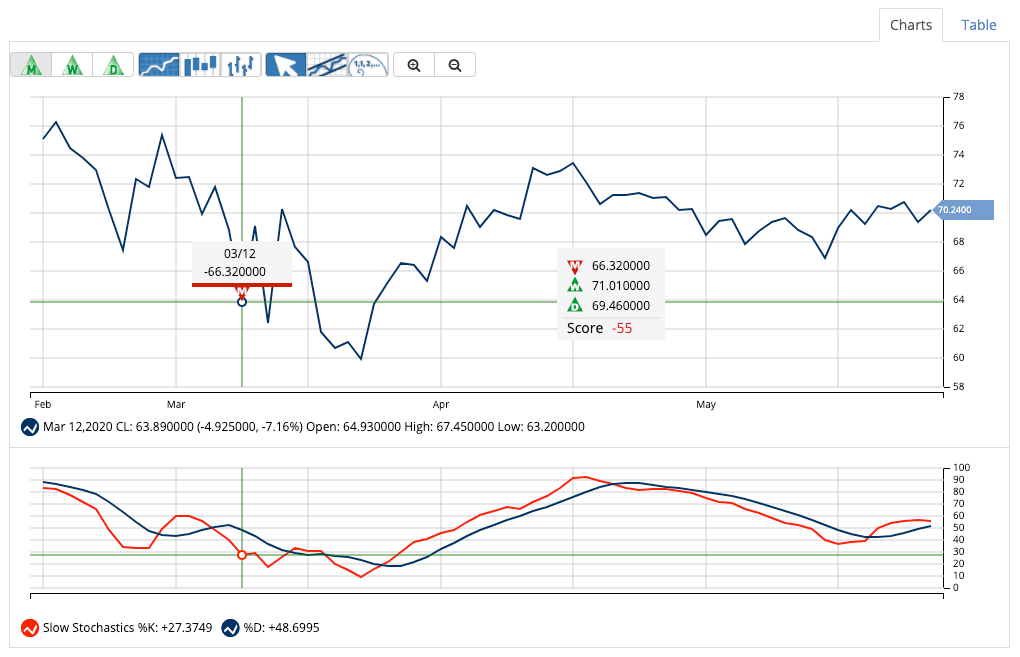

A glance at Colgate-Palmolive’s stock chart shows the beginnings of a forming upward bullish trend. The 20-day SMA is above the 50-day SMA but hasn’t quite crossed over the 200-day SMA. However, if the momentum continues, it could form a “golden cross.” If it crosses that barrier, this will provide investors with a strong bullish signal that the stock will rise even higher.

The Bottom Line

Based on Colgate-Palmolive’s full-year EPS estimates, this stock is fairly valued at around $78 per share. This is a gain of more than 10% from its current trading price range.

Investors looking for a stable large-cap stock to help reduce volatility and still deliver long-term gains should consider adding this staple to their portfolios.

The above analysis of CL was provided to MarketClub by Daniel Cross, a professional trader and financial writer.

Technical Analysis for Colgate-Palmolive (CL)?

Currently, the trend is weak for Colgate-Palmolive. With a MarketClub Chart Analysis Score of +55, the short-term technical trend for the stock has wavered.

MarketClub will continue to run every data tick through our algorithm looking for technical strength and momentum.

Members can add Colgate-Palmolive to their watchlist. We’ll sound the alert when the trend begins to strengthen in either a positive or negative direction.

Not a MarketClub member? Start your trial right now and get the trading signals for CL for the next 30 days.