The markets are rallying after the election results came in, but there’s another significant transition taking place that should get investors’ attention.

Right now, the market is seeing a shift away from technology stocks and others that thrived during the coronavirus pandemic and into sectors that reflect economic expansion instead.

Regardless of what the economy looks like, one company sees steady profits from its numerous product labels, giving investors a prime defensive stock play and outsized dividend income.

A Brand Name in Consumer Staples and Defensive Powerhouse

The Kraft Heinz Company (KHC), a $39 billion packaged foods company, is best known for its Kraft and Heinz labels.

The company has over 20 other brands under its umbrella. These brands include Grey Poupon, Oscar Mayer, Philadelphia Cream Cheese, Planters, and more. Kraft Heinz is the third-largest food and beverage company in North America and the fifth-largest in the world.

The company reported a third-quarter earnings beat of $0.70 per share compared to the $0.62 per share that the analysts expected. Sales grew 6% year-over-year to $6.3 billion. Free cash flow jumped to $1 billion. The results marked the seventh straight earnings beat giving the stock a much-needed boost.

The stock hasn’t been popular in recent history due to lower-than-expected results stemming from its massive merger to become Kraft Heinz in 2015. But it’s been five years since the deal went through, and the company is looking ahead to new opportunities. The pandemic may be unexpected positive news, with consumers switching from eating out to in-home dining.

Guggenheim upgraded the stock in late October from a “neutral” recommendation to a “buy” recommendation. Guggenheim also bumped the price target from $34 per share to $35.

The Fundamental Side

The stock trades cheaply at just 11 times earnings compared to the food products industry average of 23 times earnings.

Arguably, the stock’s most attractive feature is its beefy 5.1% dividend yield. In addition to providing investors with a steady and impressive stream of income, it should protect the stock from sharp downside movements.

The Technical Side

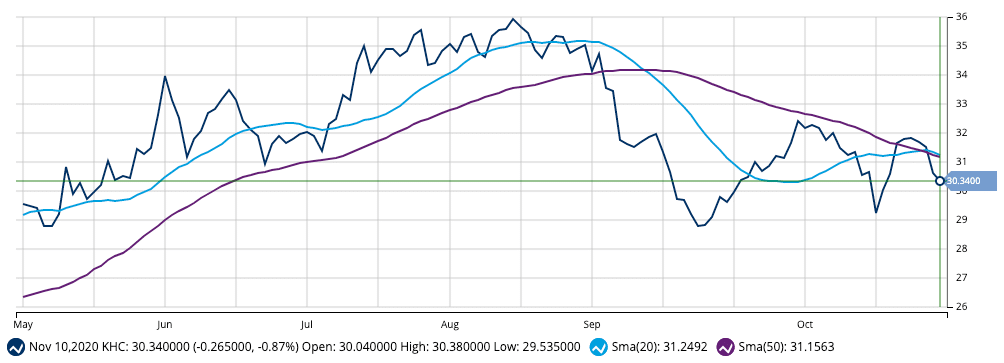

The chart for Kraft Heinz is a tough read with significant peaks and troughs over the past several months. However, the 20-day SMA recently crossed over the 50-day SMA. This cross could be a bullish signal that the stock is ready to rise.

Other metrics fall in line with market averages, so investors will want to pay attention to any news or activity that lifts the stock and contributes to its positive momentum.

The Bottom Line

Based on Kraft Heinz’s full-year EPS estimates, this stock should be fairly valued at around $36 per share. A move to fair value would represent a gain of more than 14%. This move doesn’t consider the additional 5% gains the dividend would add on top of it.

For both growth-oriented and income-oriented investors, this stock has something to offer for everyone.

The above analysis of KHC was by Daniel Cross, professional trader and financial writer.

MarketClub’s Analysis

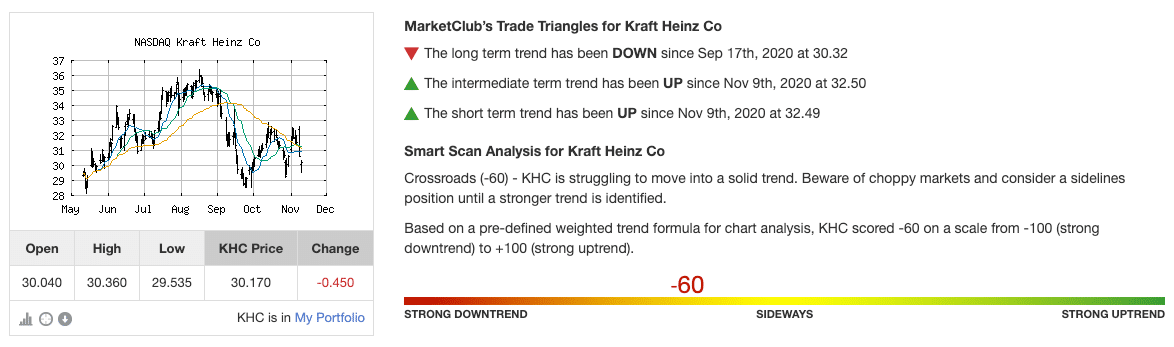

With a Chart Analysis Score of only -60, MarketClub agrees that KHC has yet to build swing momentum.

Choppy price action and a weak score suggest that members move to a sidelines position and stay there until the Trade Triangles point to an established trend.

Based on Daniel Cross’ analysis, KHC maybe a longer-term, COVID-19 recovery play. However, MarketClub members will wait until a trend is established to get into this defensive powerhouse.

Join MarketClub to see up-to-the-minute Chart Analysis Score updates for KHC.