It’s the final month of 2020, and investors, like everyone else, are looking ahead at what 2021 might bring.

There’s still a lot of uncertainty and volatility built into the market right now. However, investors are optimistic about the future. Businesses are reopening, and the world is beginning to return to a pre-COVID state of affairs.

While COVID-19 has impacted countless businesses, not every market sector is struggling. In fact, for one auto parts company, the post-COVID market is the perfect place to foster higher-than-average earnings and sustained long-term growth.

A Best in Breed Automotive Company with a Discounted Stock Price

Cooper Tire & Rubber Company (CTB) is a $1.9 billion auto parts company that manufactures and markets tires for cars, trucks, and motorcycles. It operates more than 60 facilities globally.

The company reported a phenomenal earnings beat of $2.42 per share for Q3. This smashed the $0.74 per share EPS that analysts expected.

Unlike most companies, Cooper Tire & Rubber saw an increase in year-over-year revenues from $704 million to $765 million. Impressively, estimates for the companies earnings have been raised by more than 100% in the past few months alone.

One of the catalysts working in the company’s favor is the newly resurgent economy following the coronavirus pandemic. With businesses resuming normal operations, consumers are eschewing public transportation. Instead, they are in favor of independent transportation – i.e., used cars.

As one of the few companies seeing tailwinds from the coronavirus pandemic, Cooper Tire & Rubber is perfectly positioned to take advantage of the new environment and continue to surprise analysts.

The Fundamental Case

The stock trades at just 13 times earnings – on par with the tires industry average but less than the current S&P 500 average of 41 times earnings.

Combined with an estimated 11% long-term EPS growth rate, it gives the stock a PEG ratio of just over 1. This ratio is a sign that the stock is likely trading at undervalued prices.

The 1% dividend yield comes as a bonus to investors by providing some protection against long-term downside movements.

The Technical Case

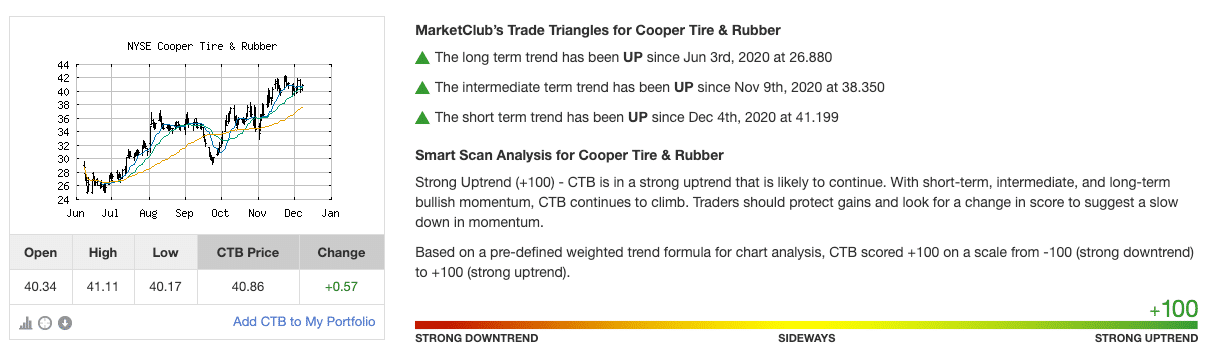

The chart for Cooper Tire & Rubber shows a general, if not always steady, trend upwards in the past year.

The 20-day SMA is trending well above the longer 50-day and 200-day SMAs. With this cross, the bullish momentum isn’t hard to pick up on.

Combined with a relatively muted RSI of 53, investors should expect to see more significant gains in the stock sooner rather than later.

The Bottom Line

Based on Cooper Tire & Rubber’s full-year EPS estimates, this stock should be fairly valued at about $48 per share – a gain of about 20% from its current trading price.

Value investors looking for a discounted stock with a lot more room to run won’t want to pass up this opportunity.

The above analysis of CTB was provided by Daniel Cross, professional trader and financial writer.

MarketClub’s Analysis of CTB

The bullish trend for CTB looks strong. With a +100 Chart Analysis Score, the stock price has the potential to keep running up the chart.

A monthly Trade Triangle detected a long-term bullish trend on June 3, 2020, at $26.88. The stock has since moved more than 50%

When will CTB’s trend cool off? Set a MarketClub Trade Triangle alert to warn you of future weakness.

Not a member? Not a problem! Start your MarketClub trial today.