A month and a half into the new year and the markets have already seen a lot of action.

From the GameStop Corp. (GME) trading mania to isolated bubbles in currency speculation, IPOs, and more, you might think that finding a stock that hasn’t fallen victim to the volatility is next to impossible. But there are plenty of solid stock picks out there if you know where to look.

For one energy company, economic bubbles don’t interfere with its long-term strategy, which means more profits in investors’ pockets.

An Energy Conglomerate and Portfolio Favorite

Phillips 66 (PSX) is a $33.7 billion oil and gas refining company spun-off of ConocoPhillips (COP) about a decade ago. It is primarily engaged in producing and marketing natural gas liquids (NGL) and petrochemicals and currently has operations in over 65 countries.

After a long stretch of consistent earnings beats, Phillips 66 reported lower-than-expected earnings of -$1.16 per share, versus the -$1.06 analysts had estimated. Still, the negative report wasn’t entirely unexpected considering the company had planned maintenance downtime during a relative lull in demand for its energy products.

As an energy refining and marketing company, this stock is inherently more stable than energy exploration companies. Phillips 66 relies more on a dedicated client base to derive its earnings. While there’s been a COVID-related decline in the refining industry, Phillips 66 is a stock play that should pay off in the long run.

The Fundamental Basis

The negative earnings make traditional ratio analysis useless. Still, investors can look at other vital figures, such as the stock’s impressive price-to-sales ratio of 0.39 and its projected future P/E ratio of 12.5. These numbers mean the stock could actually be undervalued right now.

As with most energy companies, it comes with a beefy 4.65% dividend yield, which protects investors from strong downside movements while also providing a stable income stream to reduce volatility and generate more consistent portfolio returns.

The Technical Basis

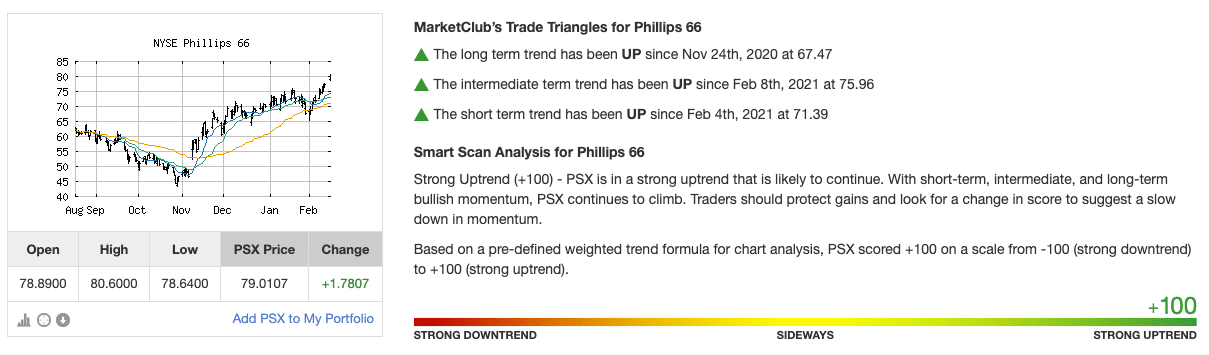

The chart for Phillip’s 66 shows a general upward trend occurring since November. And that trend shows no signs of slowing down, with three consecutively higher up days in trading combined with a 20-day SMA that is well above the 50-day and 200-day SMAs.

While the RSI reading of 65 could be an overbought signal, the reading is more likely due to the strong long-term bullish trend.

The Bottom Line

Based on Phillips 66’s full-year EPS estimates, this stock should be fairly valued at around $82 per share. A move to this price would represent a gain of more than 11% with the dividend reinvested.

Investors looking to stabilize their portfolio with a strong dividend-yielding stock shouldn’t be disappointed with PSX.

The above analysis of PSX was provided by financial writer Daniel Cross.

MarketClub’s Analysis of PSX

The technical trend looks strong for Phillips 66. With a +100 Chart Analysis Score, the short, intermediate, and long-term trends are all pointing to a move higher for PSX.

PSX triggered a monthly Trade Triangle on November 24, 2020, $67.47. The stock is up more than $11.47/share (17%) since that signal.

The Chart Analysis Score will reflect any change in momentum and will signal members of any weakness for this stock.

Want to know when PSX starts to lose steam? Set your MarketClub alert and we’ll sound the alarm for you.

Not a member? Join us now and set up your custom portfolio alerts!