The conflict between Russia and Ukraine continues to plague the international community. As a result, market volatility and uncertainty have surged.

And while much of the attention is on how this could impact certain stocks or market segments, some niches are insulated from geopolitical risks.

An oversold stock in an opportunity-rich market could give investors a bargain pick-up for one retail mega-chain.

A Household Brand and Stand Out Value Stock

The Home Depot (HD) is a $327 billion home improvement retail conglomerate and the largest in the United States. The company supplies tools, construction products, appliances, and services to North American customers.

The company reported a slight earnings beat for the fourth quarter of $3.21 EPS. Analysts’ projections were a tad lower at $3.18 per share.

One of the biggest catalysts for The Home Depot is the boom in the housing market right now. The pandemic was a boon for the self-improvement industry. A flood of homeowners took on new projects using the company’s online and in-store services. However, as vaccinations-level jumped and COVID cases declined, investors sold under the assumption that The Home Depot’s advantage was gone.

The sell-off has gone on for far too long. HD’s drop is unjustifiable at the current price. In addition, the long-term growth story of the housing market hasn’t changed either.

The stock received extensive coverage in February. Eight firms reiterated a “buy” or “outperform” recommendation with price targets between $350 per share to $430 per share. Edward Jones was the only firm to upgrade from a “hold” to a “buy” rating.

The Fundamental Basis

HD trades in line with the home improvement retailers industry average of 20 times earnings. The estimated long-term EPS growth of roughly 20% gives the stock a PEG ratio of 1. This ratio is a strong signal to investors that HD is trading in underpriced territory.

The stock also comes with a decent dividend yield of 2.1%. The dividend offers some downside protection in volatile markets while giving investors a predictable income stream.

The Technical Readout

A glance at the chart for HD isn’t immediately encouraging. Its year-to-date performance of -23.7% seems to be a sign of struggle, but there are many more bullish signals to look at.

The 50-day SMA is the top trend line, but the 20-day and the 200-day SMAs have merged. Furthermore, last week’s strong hammer pattern in the candlesticks could prompt further bullishness in the weeks ahead.

Finally, the incredibly low RSI of just 27 places the stock solidly in “oversold” territory. The fact that HD remains “oversold” is a significant achievement considering recent price action.

The Bottom Line

Based on The Home Depot’s full-year EPS estimates, this stock should be fairly valued at around $380 per share. A move to this price would represent a gain of nearly 20% from the current trading price.

Investors that want to add a premium value stock to their portfolio will want to take a second look at this stellar opportunity in the making.

The above analysis of The Home Depot (HD) was provided by financial writer Daniel Cross.

Is The Home Depot (HD) A Buy or Sell?

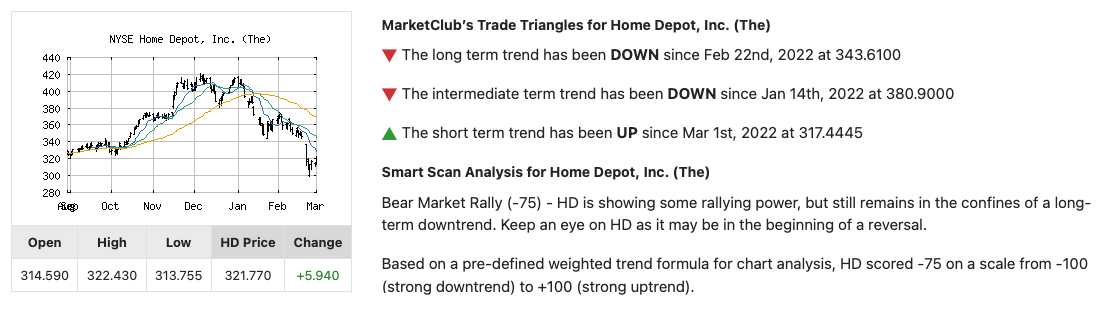

Based on MarketClub’s technical analysis tools, The Home Depot (HD) is currently in a bear market rally.

The stock is showing some rallying power but still remains in the confines of a long-term downtrend. Keep an eye on HD as it may be at the beginning of a reversal.

Get an alert when HD triggers a new signal or moves out of a neutral trend.