These are reviews and comments from real MarketClub members. These are reviews and comments from real members who learned the Options Blueprint created and taught by Trader Travis. Through exercises and video lessons, Travis will walk even the most beginner options trader through how to successfully find, execute and manage options trades using MarketClub. Join…

One of the most attractive features of a utility stock is its defensive capabilities. Consistent earnings regardless of economic conditions and low beta ratios make for an ideal safe-haven asset. When you can find a stock that meets that criteria, but comes with the additional bonus of positive momentum, it’s worth taking a closer look.…

Momentum is one of the most powerful forces in the stock market. Once a trend has started, whether it’s buying or selling activity, it tends to keep happening at an accelerated rate until it reaches a market equilibrium. In the case of one brand-name beverage maker, the bullish momentum is boosting its stock price to…

When you think of a defensive stock, a technology company is probably the last place you’d go. Traditionally, the technology sector has been home to aggressive growth stocks with high earnings, and large swings in volatility. But as technology becomes more essential for everyday business, tech companies start to change into a more defensive economic…

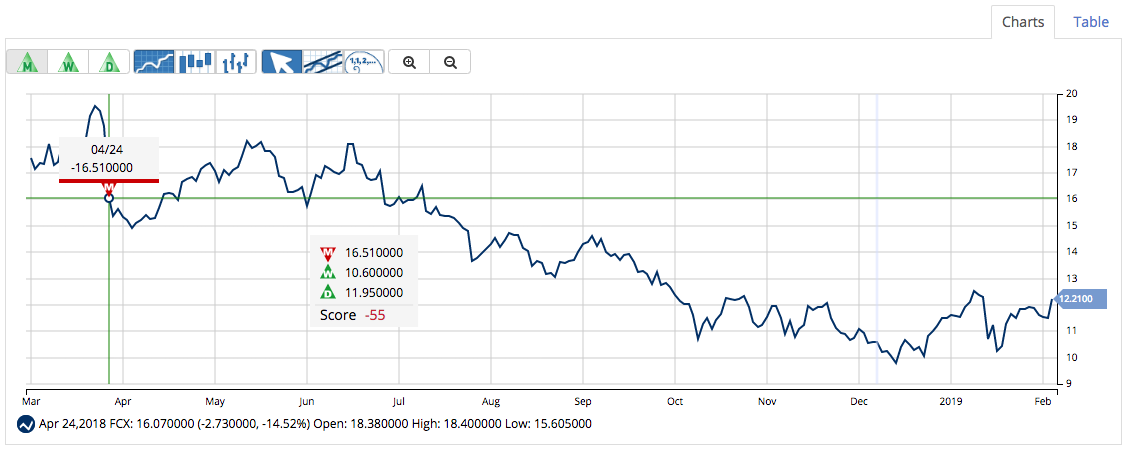

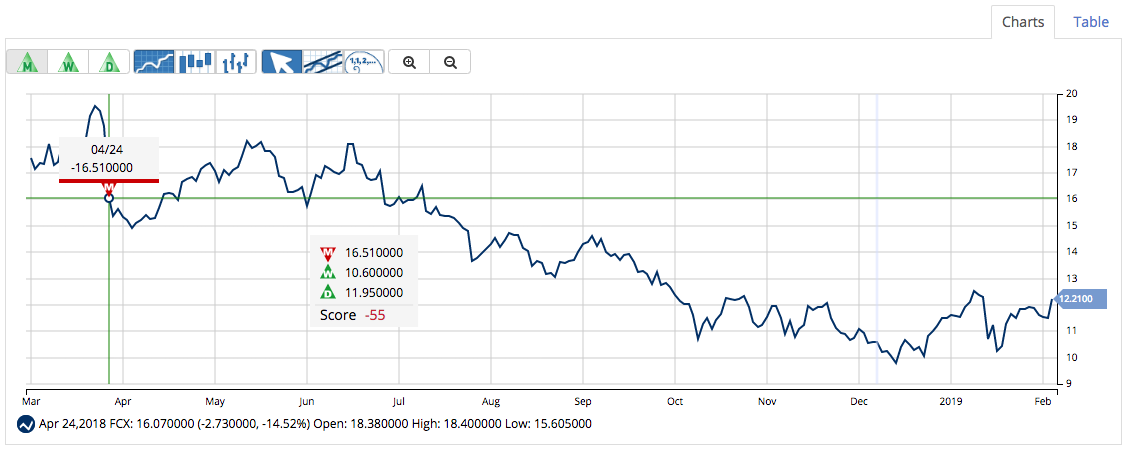

It may be counter-intuitive to declare a stock near its 52-week low as an opportunity, but some of the best value stocks are found this way. But having a low stock price alone isn’t enough of a reason to buy – it needs to have the right combination of technical and fundamental signals to tell…

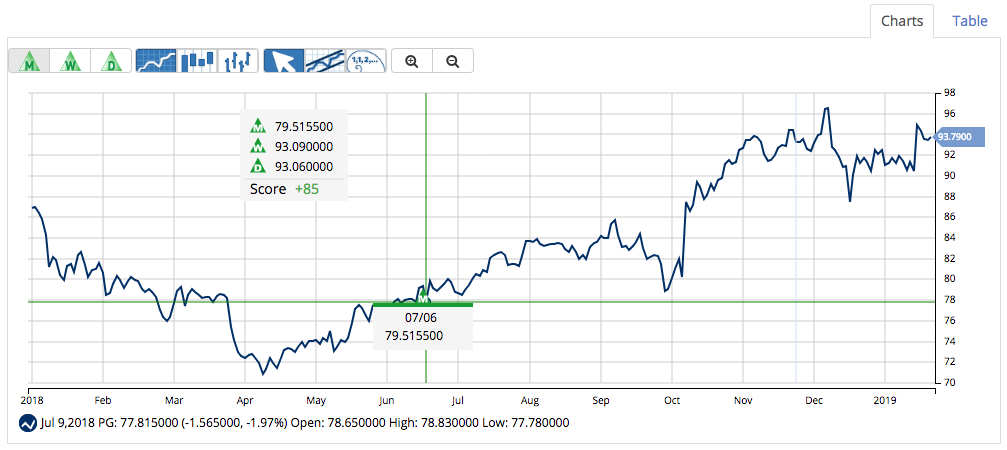

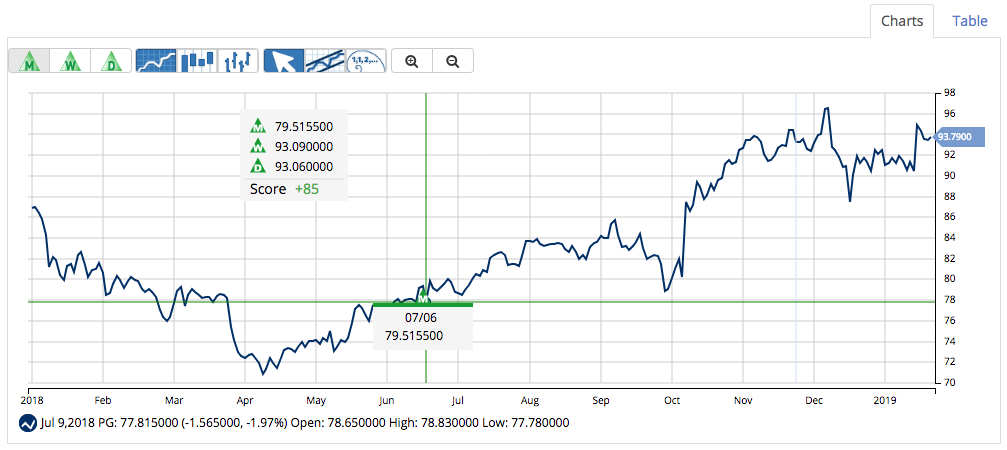

In general, large-cap stocks don’t experience a lot of movement over a relatively short period. They are too big to be easily impacted by changes in the economic cycle. As such, investors usually see them as somewhat defensive regardless of their sector. Momentum, whether positive or negative, is a powerful thing. The larger the company,…

Investors are looking anywhere and everywhere for the markets to give them some kind of clear signal… Should they go back to being bullish, or hedge against a bear market taking over this year? Guessing which direction the economy will head towards right now could lead investors around in circles with no more certainty than…

Will 2019 be the year of the IPO? Investors eagerly await the chance to snag shares of some of the most popular app-based businesses that plan to go public in 2019. These companies, all headquartered in California, have already proven their staying power and continue to create a buzz as they capture market share and…

The stock market is limping into 2019 registering overall losses for the 2018 year. All signs point to the start of a bear market and investors are getting ready for a turbulent year. Defensive stocks are quickly becoming too expensive to be of any real value, leaving investors with two options – cash out, or…