One of the most attractive features of investing in value stocks is the tendency for it to have the bad news already priced into it. That leaves a lot of unrealized upside potential just sitting in the stock, ready to move as soon as a catalyst sets it off. In the case of one manufacturing…

A High Risk, High Reward Stock Play for Growth Investors

Risk and returns are inversely correlated. It’s a truth that all investors have to manage in their portfolios. The lower the risk, the fewer returns you can expect. Generally, the higher risk, the higher expected returns. But having at least one speculative or aggressive stock holding in your portfolio can help keep it diversified, while…

Inflation is an Unexpected Tailwind for This Stock Play

Inflation has reared its ugly head in the markets once again and investors are struggling to find smart hedges that are still undervalued. While most of the obvious candidates for inflationary investing like healthcare and consumer staples have already caught the attention of most investors, there are still some great options that aren’t so obvious.…

This Bargain Buy Is What Value Investors Have Been Waiting For

The best value stock finds usually come from mundane or “unsexy” industries. Technology, biotech, and big Wall Street names like Goldman Sachs or JP Morgan typically dominate headlines and draw investors attention. But that leaves plenty of other strong companies to beat expectations and steadily grow while remaining unnoticed. And a stock no one is…

Tech Innovations Make This Well-Known Company An Attractive Buy

Sometimes the best way to invest in the technology industry isn’t through the most obvious choice. While big tech companies develop new designs, software programs, and technological breakthroughs, it’s often the companies that actually use that technology in their business model that offer the best growth opportunities for investors. For one familiar name, the application…

Phenomenal Growth in a Familiar Neighborhood Brand

The concept behind growth stock investing is relatively simple: high price-to-earnings multiples are offset by the stock’s higher-than-average EPS growth rate. In other words, high multiples are justified over time by higher earnings which in turn brings the P/E ratio back down. Companies experiencing a boom or expanding into a new market are generally good…

Add a Little Fun to Your Portfolio With This Playful Stock Pick

Sometimes it’s the companies and brands we are most familiar with that offer the greatest opportunities for profits. If it’s a product or service you personally use or are familiar with, chances are you’ll understand more about how the company is doing and what opportunities the business might face in the markets. For one leisure…

Undervalued Stock Could Impressive You with Hefty Dividends

Dividend-paying stocks are often considered conservative investments best utilized in income-driven portfolios. But high-yielding dividend stocks can add up over time and become the biggest gainers in even the most aggressive portfolios. One high-yield dividend payer has the right defensive ingredients and offensive capabilities to fulfill virtually any role an investor is looking for while…

Nike, Inc. (NKE) is a Bargain at This Price

Stocks can go up or down for many reasons that don’t always reflect a business’s actual performance. Conversely, even an economic reason that explains why a market sector might struggle can highlight outstanding companies that find ways to succeed no matter what. In the case of one globally recognized brand, a steeply discounted stock price…

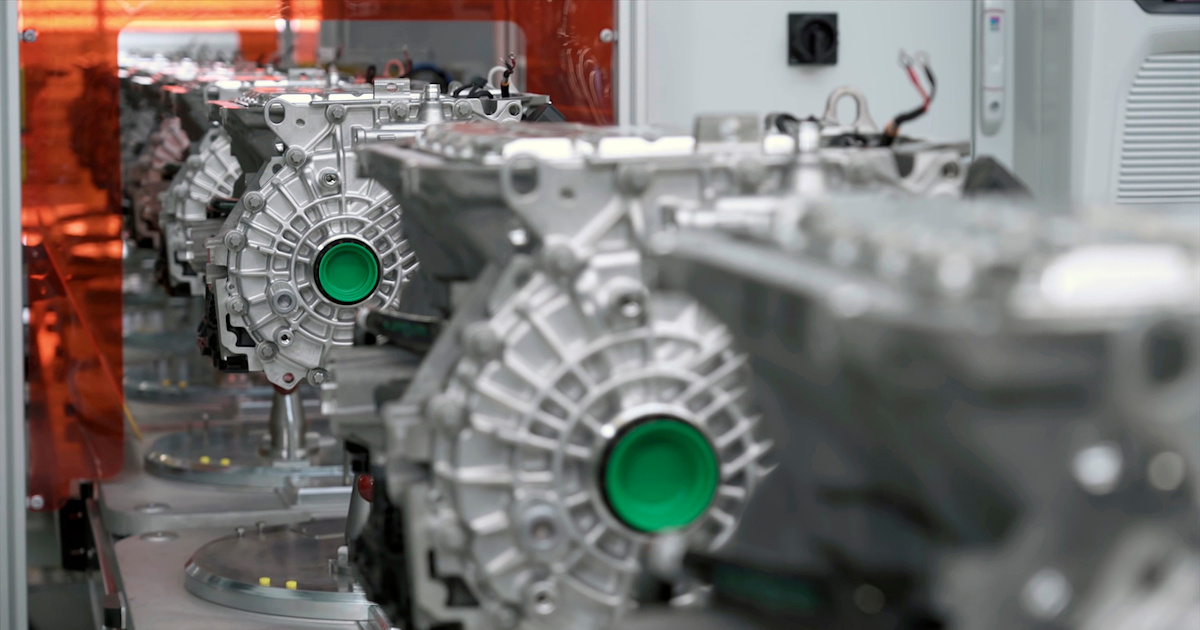

ABB Ltd’s EV Solutions Could Lead to Massive Growth

A growing global economy means a steady demand for industrial materials and products required for construction and manufacturing. And when it comes to bleeding edge manufacturing technology, there’s nothing like the robotics industry. In the case of one industrial electronics manufacturer, the current economic environment is the perfect place to find new opportunities and boost…