There’s a misconception among newer investors that the best stock play is the hot new Wall Street darling or tech IPO. But experienced investors will tell you that some of their best money-making picks have been in well-known companies with a history. There are numerous opportunities in familiar companies that can generate bigger returns than…

The “Prepper Stock” that Wall Street is Ignoring

In the classic apocalypse preparation scheme, people load up on canned food goods, portable energy generators, and of course, weapons. But regardless of whether you are a “doomsday prepper” or just a hobbyist, an apocalypse isn’t the only reason investors might want to look into these types of manufacturers. One well-known gunmaker is trading at…

A Business Technology Company That Has Room to Run

Sometimes investors can find “no-brainer” stock picks that end up being hugely profitable. For example, when the COVID pandemic first broke out and social distancing became compulsory, stocks like Zoom skyrocketed. There’s a Wall Street adage that says, “when everyone else is mining gold, be the one selling the pickaxe.” In other words, the company…

Missed Earnings Belies Underlying Strength for Transportation Stock

No matter the state of the economy, value investors are always on the lookout for bargain pickups. Strong growth, weak growth, recession – there is always an underpriced or underappreciated market segment. While everyone else focuses on technology stocks and other big Wall Street favorites, the transportation sector has been stealthily growing stronger. For one…

Surprising Millennial Play Could be a Strong Long-Term Performer

When it comes to investing, one of the keys to success is paying attention to other consumers and investors. While the baby boomer generation is entering retirement, the future of the economy is now solidly in the hands of millennials. Paying attention to millennials’ interests and trends could offer investors insight into how to make…

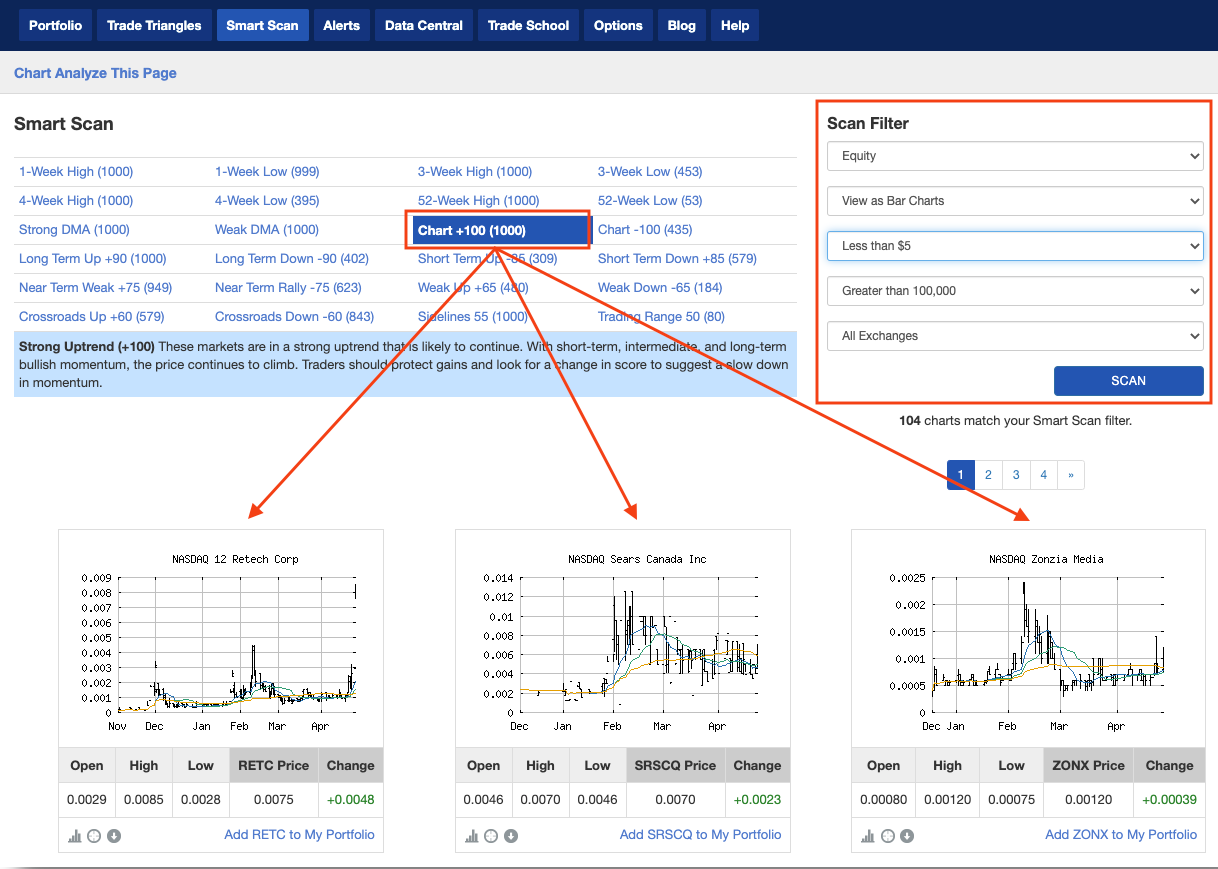

How To Find The Best Penny Stocks Every Day

What is it about penny stocks that drive traders wild and how can you find the best plays? While they are far riskier than their bluechip counterparts, penny stocks allow traders to purchase large blocks of shares with minimal funds. If a stock musters up the momentum and moves only a few cents, the payoff…

Infrastructure Stock Play Could Be the Biggest Winner of 2021

Although the market behaved skittishly last week on renewed COVID fears, the booming global economy has buoyed investor spirits, with stocks resuming their upward climb. The industrial market segment historically shines during periods of economic growth. However, it doesn’t always get the coverage that other “hotter” segments like tech stocks do. But for value investors,…

Strong Trending Stocks Under $10

It’s earnings season, and traders are eagerly waiting for reports to hit the wire. Financial giants Bank of America (BAC) and Wells Fargo (WFC) smashed expectations. While other big names like Guess? Inc. (GES) and McCormick & Co. (MKC) also surprised analysts and turned investors’ heads. While Wall Street and Main Street continue to keep…

Large-Cap Stocks vs. Small-Cap Stocks: How to Allocate Your Portfolio

Before we try to understand the difference between large-cap and small-cap stocks, let’s figure out how these terms relate to market capitalization. Market capitalization is the total value of shares of a publicly traded company. Investing in stocks through the market is an effective way of mitigating the inherent risks in a portfolio. As such,…

5 Must-Know Terms for New Forex Traders

For newbies, foreign exchange (forex or fx) trading can be fairly intimidating. There are many things that traders need to understand about the forex markets before even thinking about buying into them. Terminology is one of the simplest and most important places to start. 5 Important Forex Trading Terms Today we’ll cover five essential terms…